Featured

Calculate Net From Vat

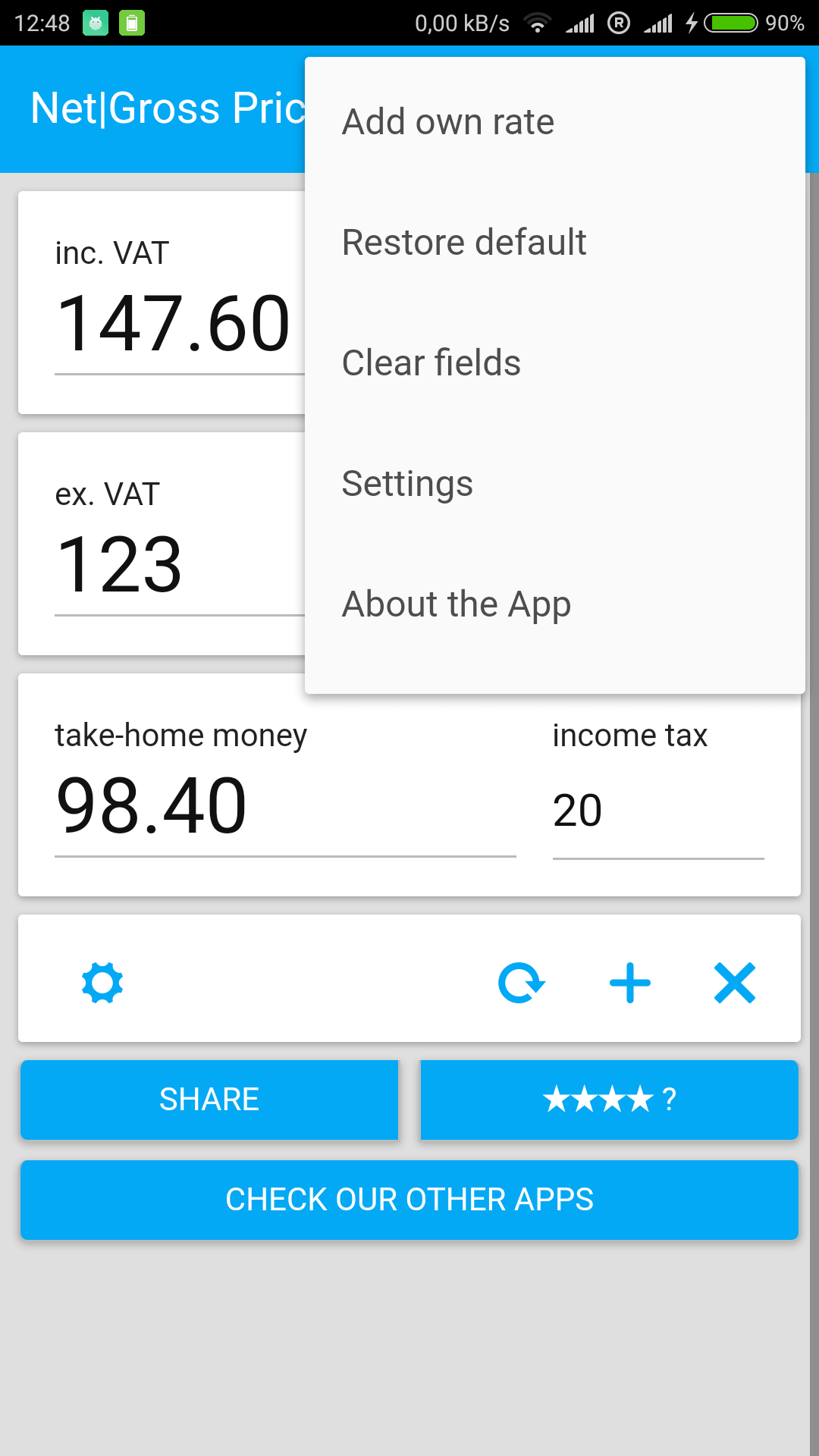

Calculate Net From Vat. Convert the percentage rate to a decimal number. Reverse uk vat calculator how to calculate uk vat backwards, forwards or in reverse.

In cell e2 write this formula and hit enter. A bike manufacturer purchases raw materials for $5.50, which includes a 10% vat. A formula to calculate that a gross purchase of £20 has had £4 vat and a net amount of £16.

The Following Example Explains The Concept Of A.

The following formulas can be used to calculate your vat, your net and gross prices. You can change it or use your own %. Excel percentage calculation to see how to work out the vat net amount.

You Will Have Your Vat Amount Calculated In E4 For Milk.

Take your vat rate, divide it by 100 and then add 1. Just put 1. in front of the vat rate, so 20% becomes 1.20, 17.5% becomes 1.175, and 5% becomes 1.05. =a2/(1+b2) cell a2 would contain the gross amount, cell b2 would contain the current vat rate and the above.

For Example, An Invoice Of £125 Multiplied By 20% Provides A Vat Figure Of £25.

For example a rate of 20% gives you a ratio of 1.20 (that's 20/100 = 0.2 + 1 = 1.2) that makes it sound complicated so here's a rule of thumb: Throughout the rest of the procedure, the calculator will display the gross value (inclusive vat) or net value (excluding vat). Vat inclusive amount / 6 = vat amount taken away.

Thank You For Any Help Given.

Consider the following example with a 10% vat assessed at each stage. Store main price in sub total d and above derived price in sub total e. On the front end of your website, you may want this to be ‘clean price’ or a ’rounded price’ for your customers to view (e.g.

That’s Exactly What Our Vat Calculator Can Do.

Fruit is subject to the reduced tax rate of 5% vat. We prepared below the table in excel spreadsheet. If you need help with vat returns, our quarterly package from £40pcm includes vat returns.

Comments

Post a Comment